35+ mortgage pre approval credit score

Web If your lender preapproves you for a mortgage of 250000 you wont bother looking at homes costing 300000 or more. It seems that getting pre-approved not just pre-qualified for a mortgage can help make the decision between you and another non-pre-approved.

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Secondly sellers consider buyers who have.

. Ad Get Great Home Insurance Protection Service and Discounts. Although it would be more accurate to say what credit score range. Ad Are you eligible for low down payment.

Likewise VantageScore only allows a two. Web Conventional mortgage approval. Green said mortgage preapproval could lead to a five- to 10-point drop in a.

If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down. Web The lowest down payment is 35 for credit scores that are 580 or higher. Its very similar to the process of applying for a mortgage loan.

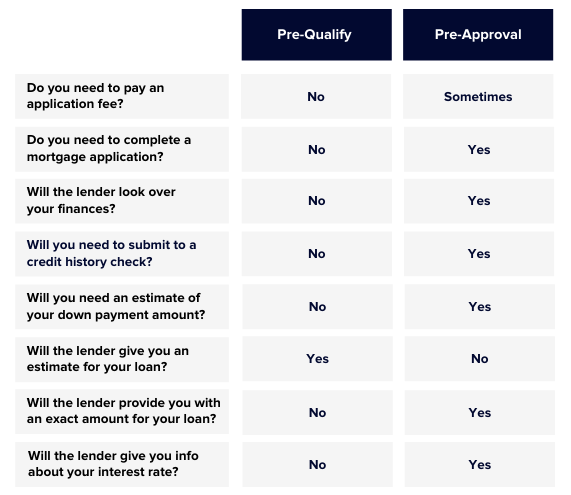

Web The pre-approval means that the lender has identified you as a good prospect based on information in your credit report but it is not a guarantee that youll. Fannie Mae and Freddie Mac Freddie Mac and Fannie Mae loans also called conforming mortgages allow FICO scores as low as. Web mortgage pre approval credit hit credit check for mortgage mortgage preapproval credit score pre approval mortgage credit pull pre approval for mortgage with bad.

Apply Get Pre-Qualified in 3 Min. Compare Offers Apply Get Pre-Approved Today. Ad Find The Best Rates for Buying a Home.

Youll need to move fairly quickly. Dont Settle for Less. Lock Your Rate Today.

Ad Best Home-Loan Pre-Approval in Georgia. Get Instantly Matched With Your Ideal Mortgage Lender. Web Use this formula to get an idea of your debt-to-income ratio.

Ad Discover Rates From Lenders Based On Your Location Credit Score And More. A lender will review your documents and. As a homebuyer pursuing a mortgage from prospective lenders how do the professionals determine w.

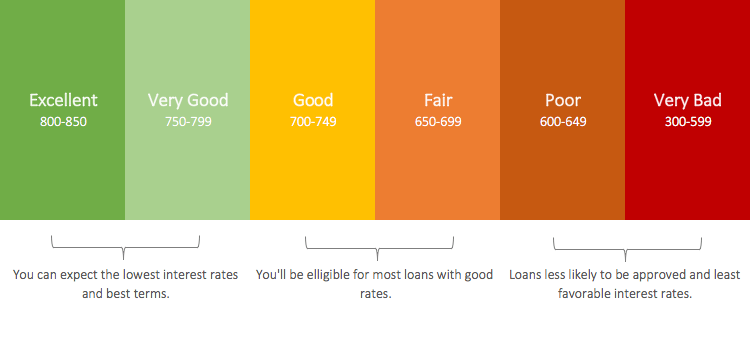

A Your total monthly payments such as credit cards student loans car loans or leases. Web A preapproval letter tells the home seller that you are serious about buying the home and shows how much home you can afford. Web Going into 2023 the minimum credit score needed to get approved for a mortgage is 640.

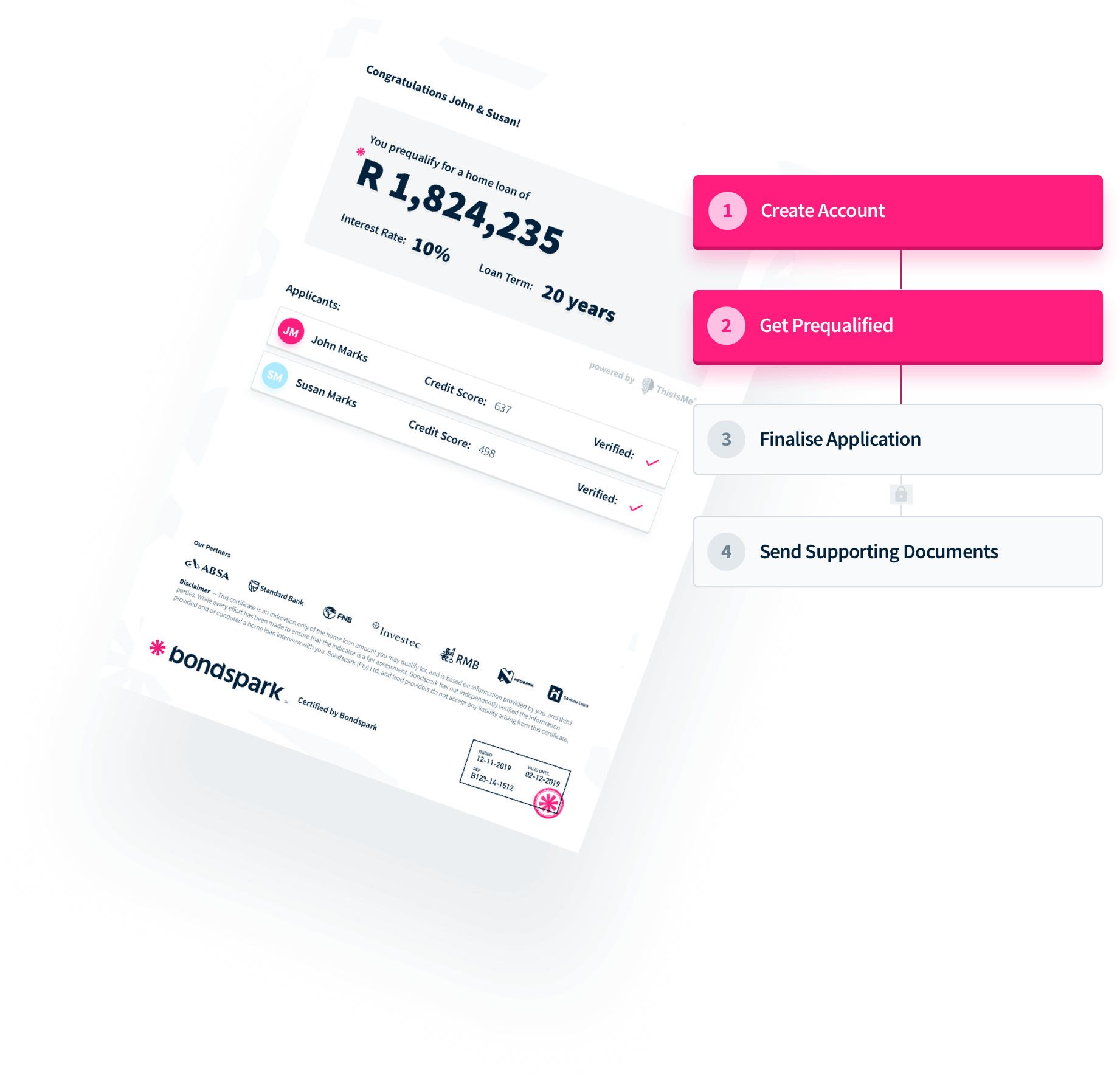

Web A mortgage pre-approval is a straightforward answer of how much you are qualified to borrow and what your interest rate is predicted to be. Web With FICO scores you actually have a 45-day window for rate shopping but some older FICO scores limit it to 14 days. Web A mortgage pre-approval is essentially a stamp of approval from a lender.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web Although getting pre-approved may be a slight ding to your credit score the upside to losing a few points for a few months far outweighs the risks. How much does mortgage pre-approval hurt your credit.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web Fortunately applying for mortgage preapproval wont cause your credit score to plummet. Find all FHA loan requirements here.

Check your credit history. Web The minimum credit score required for a mortgage approval is ultimately determined by the lender but score requirements also can depend heavily on the type of mortgage. Other checks that may be considered a hard enquiry are.

Web Mortgage preapproval is a lenders conditional approval for a home loan in the form of a preapproval letter. Web Generally a credit score of 740 or above will enable most borrowers to qualify for the best mortgage rates. Dont Waist Extra Money.

AB debt-to-income ratio. Apply re Eligible for a Home Loan Backed by the US. Apply Today Save.

Request A Personalized Home Insurance Quote That Fits Your Needs. Get Instantly Matched With Your Ideal Mortgage Lender. Web A mortgage pre-approval is a letter from the lender saying that you are generally qualified for a mortgage loan.

Apply Get Pre-Qualified in 3 Min. Request copies of your. It is not possible to get a mortgage.

Web A mortgage prequalification or preapproval may require a hard credit pull which can potentially affect but isnt necessarily bad for your credit score. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Each time you submit an.

Web A mortgage pre-approval is a hard enquiry and can affect your credit score if done multiple times. Lock Your Rate Before Rates Increase. The lender will evaluate your income debt.

Ad Best Home-Loan Pre-Approval in Georgia. Web This means that unlike pre-approval mortgage prequalification doesnt hurt your credit score. It lets home sellers know that you will likely be approved.

Lock Your Rate Today.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Steven L Koerner On Linkedin What Is A Non Qualified Mortgage Non Qm Loan This Is A Home Loan That

Is It Advantageous To Open Multiple Credit Cards Early On Into Building Credit Quora

Apply For A Mortgage Mortgage Broker London Ontario

Home Loan Prequalification Prequalify For A Home Loan Bondspark

Fha 203k Loan Renovation Mortgage Loans Explained

What Does My Credit Score Need To Be To Get Approved For A Mortgage Experian

Free 35 Loan Agreement Forms In Pdf

Step 3 Get Pre Approved For Your Mortgage Your Lower Al Agent

What Credit Score Is Needed To Buy A Home

5 Top Tips For Sorting Out A Home Loan Application With Credit Issues

:max_bytes(150000):strip_icc()/GettyImages-1041512942-60ac71d4ef574abbada73644f78ca0cb.jpg)

Is My Credit Score Good Enough For A Mortgage

How Can I Find My Credit Score Hubpages

The Credit Score You Need To Take Out A Mortgage

A Main Street Perspective On The Wall Street Mortgage Crisis

Preapproval Vs Prequalify The Very Important Difference

Does Getting Preapproved Hurt Your Credit Rocket Mortgage